Abstract Hualin Securities Co., Ltd. verifies the verification of the permanent replenishment of working capital by the raised funds raised by Henan Xinda New Materials Co., Ltd. Hualin Securities Co., Ltd. (hereinafter referred to as “Hua Lin Securities†or “Suggested Agencyâ€

Verification opinion of Hualin Securities Co., Ltd. on the use of fund-raising funds from Henan Xinda New Materials Co., Ltd. to permanently replenish working capital

Hualin Securities Co., Ltd. (hereinafter referred to as “Hua Lin Securities†or “Sponsorship Agencyâ€) as the initial public offering of Henan Xinda New Materials Co., Ltd. (hereinafter referred to as “Xinda New Materials†or “Companyâ€) The board of directors listed on the board of directors, according to the "Administrative Measures for Securities Issuance and Listing Sponsorship", "Shenzhen Stock Exchange GEM Listing Rules" and "Shenzhen Stock Exchange GEM Listed Companies Standard Operation Guidelines" requirements and requirements for the new New Materials has carefully checked the use of funds raised from the fundraising project to permanently replenish liquidity. The details of the verification are as follows: First, the basic situation of raised funds

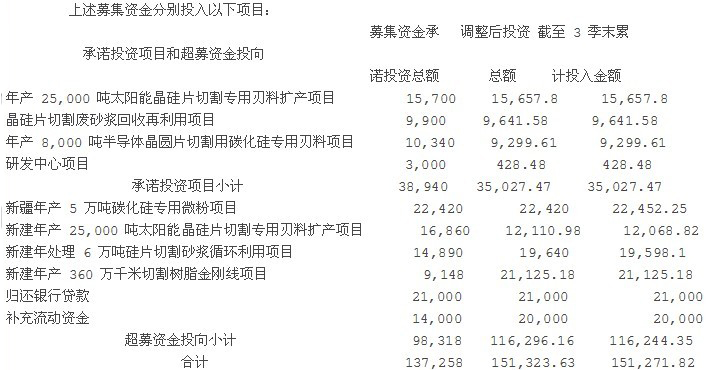

Approved by China Securities Regulatory Commission, China Securities Regulatory Commission [2010] No. 532, Xindaxin Materials publicly issued 35 million ordinary shares (A shares) to the public at an issue price of RMB 43.40 per share, raising a total of RMB 1,199.0 million. After the issuance expenses of 38.92 million yuan, the net amount of funds raised was 148.08 million yuan. The above raised funds have been verified by Shenzhen Pengcheng Certified Public Accountants Co., Ltd. issued by Shen Pengzhengzi [2010] No. 171 “Capital Verification Reportâ€. The above raised funds have all been deposited in the fundraising account management.

Second, the fundraising project savings plan

The company's "annual production of 25,000 tons of solar wafer cutting special blade material expansion project", "crystal wafer cutting waste mortar recycling and reuse project", "annual production of 8,000 tons of semiconductor wafer cutting silicon carbide special cutting material project" 4 projects including the newly-built 25,000 tons of solar crystal wafer cutting special cutting material project have completed the final accounts on October 24, 2012, and were reviewed and approved by the 14th meeting of the second board of directors of the company. The raised funds of the fundraising projects were RMB 60,090,300 and the interest was adjusted to “Newly built 3.6 million kilometers of cutting resin diamond line projectâ€.

The company's “new annual processing 60,000 tons silicon wafer cutting mortar recycling project†and “Xinjiang annual output of 50,000 tons of silicon carbide special micro powder project†have been completed and completed in the near future, and the company’s second board of directors is the twenty-ninth The meeting was considered and approved. Among them, the “new annual treatment of 60,000 tons of silicon wafer cutting mortar recycling project†saved funds of 419,000 yuan, and “Xinjiang annual output of 50,000 tons of silicon carbide special micro-powder project†raised funds of 322,500 yuan, raising funds for the project. Account interest. The funds raised and the savings of the above two fundraising projects are as follows:

So far, the company's fund-raising construction projects have all been completed. Except for the “new project to produce 3.6 million kilometers of cutting resin diamond line projectâ€, the final settlement of the project has been completed. As of October 2013, the company's fund-raising account balance (including interest) was 1.8 million yuan. The company intends to transfer the balance of all fund-raising accounts to its own fund account and permanently replenish the working capital.

Third, the main reason for the savings of funds raised

During the project implementation process, the company optimized the project design and construction plan, controlled the construction cost and equipment procurement cost through strict bidding procedures, and effectively saved the capital investment under the premise of ensuring the quality of the project.

Fourth, the need to use surplus funds to permanently replenish working capital

The company's fund-raising construction projects have all been completed. Except for the “Newly built 3.6 million-kilometer-cut resin diamond line projectâ€, the project has been completed and the final accounts have been completed. Transfer the balance of the fund-raising account of 1.8 million yuan to the self-owned fund account and permanently replenish the working capital to meet the company's partial liquidity requirements and improve the efficiency of the use of funds, thereby improving the company's operating efficiency and maximizing the interests of the company and shareholders. .

The supplementary fund raised by the current fund is limited to the production and operation related to the main business, and will not be used for new stock placement, purchase, or for stocks and derivatives, convertible corporate bonds, etc. through direct or indirect arrangements. transaction. The company has not conducted high-risk investments such as securities in the past 12 months and has not promised to invest in high-risk securities such as securities in the next 12 months.

V. Sponsor's verification opinion

After the above verification, the sponsors issued the verification opinions as follows:

1. New Daxin Materials The above-mentioned savings fund use plan has been reviewed and approved at the 29th meeting of the second board of directors of the company. The independent directors issued independent opinions with clear consent. The company implemented special account management for the raised funds and fulfilled the necessary Legal process. This plan uses the surplus raised funds of 1.8 million yuan to permanently supplement the company's working capital, in line with the China Securities Regulatory Commission's "Listed Companies' Regulatory Guidelines No. 2 - Regulatory Requirements for the Management and Use of Listed Companies' Raised Funds" and "Shenzhen Stock Exchange Ventures" Provisions on the Listing Rules of the Board of Stocks and the “Guidelines for the Standard Operation of Listed Companies on the Growth Enterprise Market of the Shenzhen Stock Exchangeâ€.

2. The use plan of the raised funds will be used for the company's main business, which will effectively improve the efficiency of the company's capital use and reduce the company's financial expenses, in line with the interests of all shareholders. At the same time, the plan for the use of funds raised in this period has not contradicted the implementation plan of the original fund-raising investment project, and will not affect the normal implementation of the original fund-raising investment project, nor will there be a situation in which the fund-raising investment will be changed in a disguised form and the interests of shareholders will be harmed.

3. Based on the above opinions, we believe that it is reasonable and necessary to use the surplus raised funds of 1.8 million yuan to replenish the company's working capital, and agree to the plan for the use of funds raised by Xinda New Materials. Savings from surplus funds are limited to the production and operation related to the main business, and may not be used for direct placement or subscription of new shares, purchases, or transactions for stocks and derivatives, convertible corporate bonds, etc.

Sponsor's signature: Yang Yanjun, Qiao Xusheng

Hualin Securities Co., Ltd.

Hualin Securities Co., Ltd.

Led Track Light,Track Lighting,Modern Track Lighting,Kitchen Track Lighting

Foshan Brinno Technology Co.,Ltd , https://www.brinnolighting.com