This week, crude oil cuts caused everyone's attention. On Thursday, the price of oil was clearly reduced. However, the rebound was limited. The heroes of the domestic market in the week were Shanghai Hujiao and Shanghai Aluminum. Friday’s duo led the gains, and the overall fluency of the week was more than 5%. Last week, after the eruption of star agricultural products, it fell slightly this week.

On the 20th, the Shanghai fuel oil 612 contract was encouraged by the rebound in crude oil, reported at 2966 yuan / ton, up 47 yuan or 1.61%. When Zhouhuo fuel experienced the plunge of international crude oil and stabilized at the 2900 line, it is evident that domestic demand growth is not a false one. The international oil price stabilized in the week, relying solely on production cuts. Saudi Arabia expressed its support for the reduction of production by the Organization of Petroleum Exporting Countries (OPEC). On the 19th, crude oil prices in the international market rebounded. On the New York Mercantile Exchange, light sweet crude for delivery in November rose by 85 cents to close at $58.50. The Organization of Petroleum Exporting Countries (OPEC) reached an agreement on Friday to cut production by 1.2 million barrels per day. This is the first time OPEC has cut production in more than two years. The reduction in output amounted to an average of 4.3% of OPEC's September production, which exceeded the market’s original forecast. Since January 2002, the rate of production reduction has been larger. OPEC has decided to reduce daily production to 26.3 million barrels since November 1.

Hujiao continued to rebound on Friday, 701 contracts closed at 20,600 yuan / ton, which is the higher closing price since August 28 this year. China’s rubber imports reached 170,000 tons in August, a year-on-year increase of more than 19.7%, indicating that China’s consumption is very strong. The macroeconomic regulation and control of related departments on Friday made a success, and the follow-up and control efforts will slow down; Thailand’s severe floods have seriously affected the rubber supply; China’s auto consumption has continued to grow steadily. It is expected that automobile production will increase by 20% or 3.7 million vehicles in 2006, and the strong growth of China’s economy shows that natural rubber prices can continue to be high. Rubber spot dealers expressed concern about the current rubber consumption: first, the possibility of tariff reduction. With the rise in rubber prices, the decline in the import tariff of natural rubber was discussed by the upper level. Secondly, from the status quo of tire factories, the tire backlog was lower. Large, poor exports; while the tire export situation is not good, a large inventory of tire inventory, domestic tire manufacturers, capital flows weak, it is prone to problems.

On the 20th, the Shanghai fuel oil 612 contract was encouraged by the rebound in crude oil, reported at 2966 yuan / ton, up 47 yuan or 1.61%. When Zhouhuo fuel experienced the plunge of international crude oil and stabilized at the 2900 line, it is evident that domestic demand growth is not a false one. The international oil price stabilized in the week, relying solely on production cuts. Saudi Arabia expressed its support for the reduction of production by the Organization of Petroleum Exporting Countries (OPEC). On the 19th, crude oil prices in the international market rebounded. On the New York Mercantile Exchange, light sweet crude for delivery in November rose by 85 cents to close at $58.50. The Organization of Petroleum Exporting Countries (OPEC) reached an agreement on Friday to cut production by 1.2 million barrels per day. This is the first time OPEC has cut production in more than two years. The reduction in output amounted to an average of 4.3% of OPEC's September production, which exceeded the market’s original forecast. Since January 2002, the rate of production reduction has been larger. OPEC has decided to reduce daily production to 26.3 million barrels since November 1.

Hujiao continued to rebound on Friday, 701 contracts closed at 20,600 yuan / ton, which is the higher closing price since August 28 this year. China’s rubber imports reached 170,000 tons in August, a year-on-year increase of more than 19.7%, indicating that China’s consumption is very strong. The macroeconomic regulation and control of related departments on Friday made a success, and the follow-up and control efforts will slow down; Thailand’s severe floods have seriously affected the rubber supply; China’s auto consumption has continued to grow steadily. It is expected that automobile production will increase by 20% or 3.7 million vehicles in 2006, and the strong growth of China’s economy shows that natural rubber prices can continue to be high. Rubber spot dealers expressed concern about the current rubber consumption: first, the possibility of tariff reduction. With the rise in rubber prices, the decline in the import tariff of natural rubber was discussed by the upper level. Secondly, from the status quo of tire factories, the tire backlog was lower. Large, poor exports; while the tire export situation is not good, a large inventory of tire inventory, domestic tire manufacturers, capital flows weak, it is prone to problems.

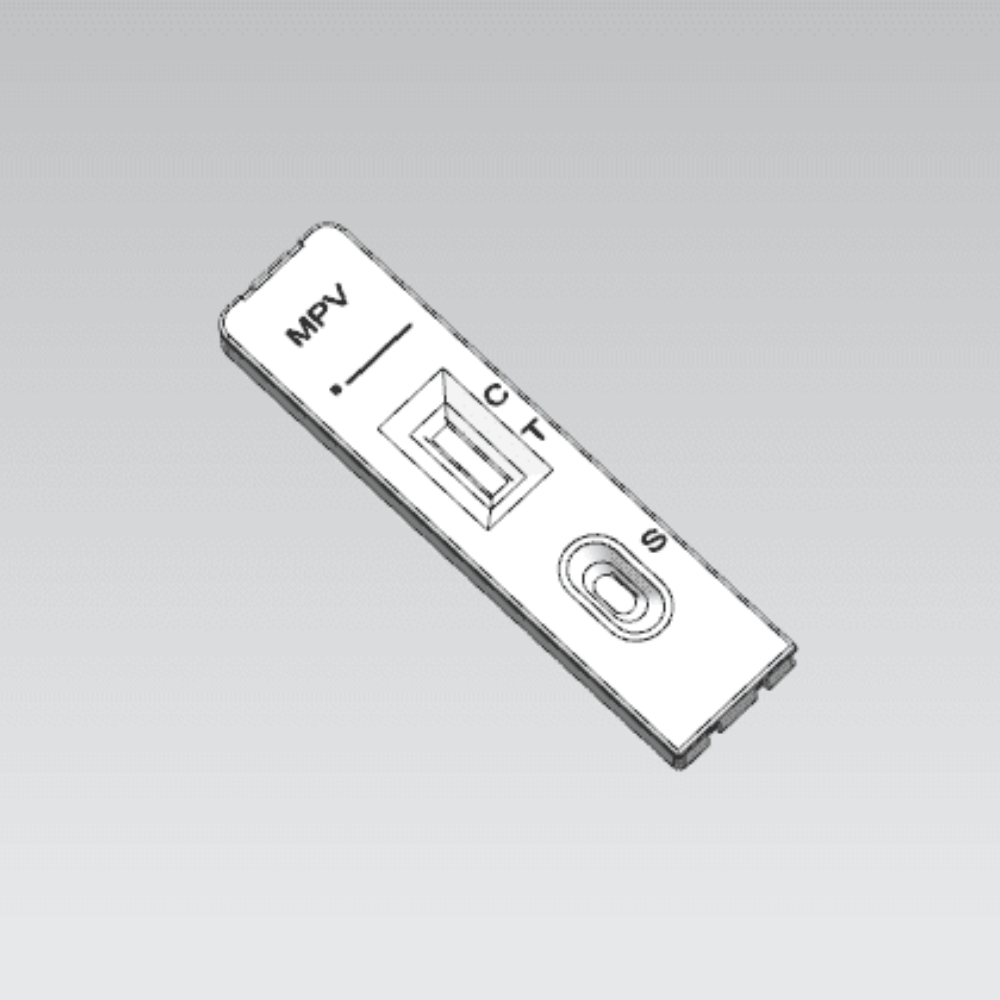

Human Monkeypox Virus (MPV) Antigen Rapid Test Device (colloidal gold) is an in vitro diagnostic test for the qualitative detection of human monkeypox virus antigens in Nasopharyngeal swab,saliva and exudate of blain using the rapid immunochromatographic method. The identification is based on the monoclonal antibodies specific for the human monkeypox virus antigen. It will provide information for clinical doctors to prescribe correct medications.

monkeypox virus test,monkeypox virus,virus monkeypox,monkey poxs,monkey pox

Yong Yue Medical Technology(Kunshan) Co.,Ltd , https://www.yongyuecultureflask.com