Today's point of view

Today, the prices of major domestic steel products continue to fluctuate and weaken, and the market mentality is not good. On the one hand, the futures market eventually went down in the process of shocks, and the merchants' prices were obviously affected. On the other hand, in the hot season in July, most of the downstream purchases waited or reduced, the transaction was difficult to support, and the price decline made the transaction even more light. Merchant operations have to be based on shipping. After the market analysis, the steel mill policy remained strong in August, and the cost remained high. Under the off-season effect, the steel price continued to fluctuate within a narrow range.

Macro hotspot

1. [Non-ferrous metal futures mostly closed down, fuel led the decline] Fuel closed down 5%, crude oil, apple fell more than 3%, Shanghai zinc, Shanghai nickel, Shanghai lead, manganese silicon fell more than 2%, ferrosilicon, Zheng cotton, Cotton yarn, Shanghai tin, eggs, glass, thread, Zheng alcohol, Shanghai copper, Shanghai silver, corn, Shanghai gold, plastics, Zheng coal, etc. closed down. White sugar, rapeseed meal, soybean meal and coking coal closed up more than 1%, soy oil, Shanghai aluminum, rubber, coke, Zhengyou, hot coil, iron ore and so on.

2. [The index will rebound after the afternoon, and the chicken and fullerene sectors will continue to strengthen]

The Shanghai Composite Index closed at 2798.13 points, down 0.57%, with a turnover of 124 billion.

The Shenzhen Component Index closed at 9288.16 points, down 0.35%, with a turnover of 184.6 billion.

The GEM closed at 1621.63 points, up 0.29%, with a turnover of 70.4 billion.

3. [The mid-year meeting of the State-owned Assets Supervision and Administration Commission revealed new ideas for the reform of state-owned enterprises in the second half of the year] The meeting proposed that the debt risk should be strictly controlled to further reduce the asset-liability ratio; the financial business should be strictly controlled and the integration and integration should be carried out in a solid manner. The meeting pointed out that in the second half of the year, it is necessary to steadily promote the strategic restructuring of central enterprises in the fields of equipment manufacturing, coal, electric power, communications, and chemicals. In addition, in the second half of the year, we will steadily promote the diversification of equity at the level of 2-3 central enterprise groups, and promote the reform of mixed ownership in commercial enterprises with full-scale competition in industries and fields; support operating companies to participate in central enterprise IPOs, market-oriented debt-to-equity swaps. , equity diversification and mixed ownership reform. The meeting also pointed out that for a loss-listed company, it can achieve value enhancement through mergers and acquisitions of high-quality assets and revitalization of stock resources.

4. [Central Bank Sun Guofeng: Appropriate adjustment of the channels for loan creation to offset the effect of bank shadow contraction] Sun Guofeng, director of the People’s Bank of China Financial Research Institute, believes that in general, it is still necessary to maintain monetary growth and economic growth and price levels to maintain A relatively reasonable relationship. At present, the shadow of the bank has been clearly governed, the scale has shrunk, and the amount of money created by the bank's shadow has also contracted to some extent. It is necessary to properly adjust the channels for creating money for loans to offset the effect of bank shadow shrinkage.

Market today

Raw material

Billet: The price of the national billet market has risen and fallen. Tangshan billet fell 20, Shanxi billet rose 20 yuan / ton, other regions temporarily stabilized. In the early morning, the Qian'an area rose by 10 yuan/ton, the billet turnover was generally weak, and the downstream finished product prices rose steadily. Tangshan billet straight hair transaction is generally weak, warehousing spot 3770 or so tax-included high price is difficult to deal with, steel futures run, the downstream finished parts are generally sold, the overall transaction is weak.

Domestic mines: Some market prices in the main domestic production areas have been temporarily stabilized. The price of Hainan mining in South China rose by RMB 5/ton. Specifically, the North China-Tangshan 66% dry-based tax-included cash factory is 645-655 yuan / ton, the west of the 66% dry-based tax-included cash out of 630-640 yuan / ton, Qian'an 66% dry basis tax-included cash factory 655-665 yuan / ton; Zunhua 66% dry basis tax-included cash factory 635-645 yuan / ton; Kuancheng 65% dry basis tax-included cash factory 570 tons;

Imported mines: The price of imported mineral traders on the 17th was basically the same as yesterday. The mainstream price of PB powder in Tangshan Port and Shandong Port was 460-465 yuan/ton. The price of PB powder in Tangshan Port was firmer, less than 455 yuan/ton. Big. In the case of the steel mills, the enquiries were normal. In the morning, the market was in a good mood. The mood in the afternoon continued to be cold in the morning, and the transaction did not improve. As of press time, the whole day's transactions are as follows: Caofeidian Port: Mixed Powder 347, Newman Sieve Rear Block 675; Jingtang Port: PB Powder 460/465, Newman Sieve Rear Block 675; Qingdao Port: PB Block 640, Rob River Powder 320; Rizhao Port: PB powder 456 (unit: yuan / ton).

Steel spot

Construction steel: Today's domestic construction steel prices are weakly adjusted. According to the specific price, the average price of 25 major cities nationwide was 4178 yuan/ton, which was 14 yuan/ton lower than that of the previous trading day. The East China region fell across the board, and the South China, Central China, Southwest China and Northwest China were narrowly adjusted. North China and Northeast China The region is mainly stable. Specifically, today's snail low volatility, terminal procurement enthusiasm is not strong, some merchants for the second time the shipping price is lowered, the low snail rebounds in the late afternoon, the market atmosphere is warming, the volume is heavy. At present, some merchants have been upside down, and the willingness to continue to drop prices is not strong. The support at the cost end is strong. At the same time, the volume of the late market has also boosted the market mentality. On the whole, it is expected that domestic construction steel will weaken tomorrow. .

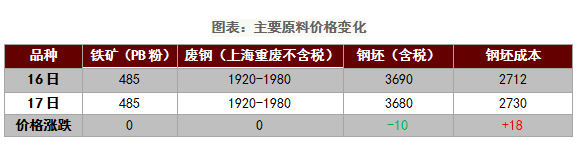

Hot-rolled coils: Today's hot rolling prices in 24 major cities nationwide fell slightly. The average price of 3.0 hot-rolled coils was 4,309 yuan/ton, down 7 yuan/ton from the previous trading day, and the national average price of 4.75 hot-rolled coils was 4251. Yuan/ton, down 7 yuan/ton from the previous trading day. Today's futures market fluctuated and operated, the market wait-and-see mood was strong, and the merchant's offer fell steadily. At present, market demand is still weak, market transactions are generally poor, and some markets have seen price declines, but the terminal purchase intention is not strong. In the short term, market demand is unlikely to improve significantly, and late stocks have increased pressure, and market prices are still declining. However, considering the cost factor, there is not much room for price downside. In addition, today Tangshan billet market price fell 10 yuan / ton, the current price of carbon billet is 3680 yuan / ton. On the whole, it is expected that the price of the hot-rolled market will be weaker tomorrow.

Plate: Today, the domestic plate market price fell slightly. The average price of 20mm plate in 23 major cities nationwide was 4355 yuan/ton, down 8 yuan/ton from the previous trading day. Today's market prices are weak, the business mentality is obviously weakening, and the continued poor turnover is the main factor leading to price pressure. With the recent arrival of resources, in the case of sluggish demand, the late market inventory has an upward trend. In terms of steel mills, prices of some second-tier steel mills fell slightly, which also contributed to the weakening of market prices. In the short-term, the market demand is difficult to improve significantly, and the market sentiment is empty. In addition, today Tangshan billet market price fell 10 yuan / ton, the current price of carbon billet is 3680 yuan / ton. On the whole, it is expected that the price of the plate market will be weaker tomorrow.

Cold-rolled coils: Today's national cold-rolled prices are temporarily stable and weak. Price: 1.0 national cold rolling average price of 4,722 yuan / ton, compared with the previous working day price decreased by 2 yuan / ton. The main market price: Shanghai market 1.0mm WISCO coil plate offer 4660 yuan / ton, Guangzhou market 1.0mm anang steel coil offer 4670 yuan / ton, Tianjin market 1.0mm anang steel coil offer 4540 yuan / ton. In terms of market: Today's business quotations are stable, and some merchants are selling at a lower price. Due to the flat market demand, the overall cold-rolling shipments are poor, but at the same time, local traders do not have enough inventory, which is still at a reasonable level. There is no inventory pressure. At the same time, supported by the cost, there is limited room for the cold rolling price to fall in the short term. It is expected that the cold rolling will continue to fluctuate in the near future.

Steel: Today's domestic steel market is operating in a narrow range, and the overall transaction is still flat. Specifically, the price of Tangshan profiles has stabilized and stabilized in the early session, with the work tank rising 10-20 and the angle is stable. The price remained stable in the afternoon, because the price of steel billet was strong, and Tangshan environmental protection limited production, so the merchants have a strong willingness to price. In the hot summer season, the downstream demand is weak. In addition, the continuous rainfall in Tangshan today has affected the market's transactions to a certain extent. In the afternoon, the market transactions followed the morning state and the performance was flat. The price of East China profiles was adjusted in a narrow range. The overall market maintained a wait-and-see attitude, and some cities had loose prices. At this stage, with the high futures running, the market will be more willing to price; the price of South China profiles is basically stable, and some small-size angles are slightly raised due to the low price of the goods. Low-cost shipments, but on the other hand, downstream demand is still flat, and prices are hard to pick up. On the whole, in the case of low demand and high cost, there is a high probability that the steel market in the future will continue to hold steady.

Steel pipe: Today's domestic pipe prices are adjusted in a narrow range. In terms of varieties, the average price of welded pipe 4 inch 3.75mm is 4370 yuan/ton, up by 1 yuan/ton from the previous trading day; the average price of galvanized pipe 4 inch 3.75mm is 5080 yuan/ton, up from the previous trading day. 3 yuan / ton; seamless pipe 108 * 4.5mm national average price of 5,254 yuan / ton, unchanged from the previous trading day. In terms of pipe factory, Tianjin Youfa, Juncheng and Lida ex-factory prices are stable, individual specifications are raised by 20-30 yuan/ton, and Linyi mainstream seamless pipe factory hot-selling price is 4850 yuan/ton. In terms of welded pipes and galvanized pipes, Ruifeng's strip prices are stable. In terms of spot market, today's market prices fluctuated slightly and the shipments were not good. Black futures fluctuated weakly throughout the day but the market pulled up and increased the market wait-and-see mood. Short-term market prices are expected to continue to fluctuate within a narrow range. In terms of seamless pipes, Shandong pipe billet is stable, Jiangsu pipe billet is down by RMB 10-50/ton. In terms of pipe plant, Shandong pipe plant is holding steady operation, and Jiangsu mainstream pipe plant is up by RMB 100/ton. The market is not warm, the inquiry is mostly based on old customers, but the market price is relatively firm, the high temperature is off season, the merchants are careful to prepare the warehouse, and the short-term seamless pipe price is expected to run.

Futures: Today's domestic black commodity futures are mixed, trading is general, the main funds are outflowing, of which: double-focus performance today, a small increase; iron ore, followed by a slight decline; finished materials are relatively weak. Specifically: At present, the domestic spot market is cold, mainly due to the high temperature weather in the country, leading to the sluggish downstream demand, insufficient spot price increase, and the settlement price of steel billet in Tangshan area has declined. The supply side is affected by environmental protection policies. The contraction elasticity is higher than the demand, and the futures also ushered in a certain adjustment. On the whole, with the gradual resumption of the factory in Xuzhou, the profit of the steel mills has gradually withdrawn, and there is room for short-term raw materials. The overall downside of the black system is limited. The above recommendations are recommended, and the wait-and-see is the main focus. Position.

Ufo Solar Light,Garden Solar Lights Outdoor,Solar Garden Lights,Solar Lights For Garden

Yantai LUHAO Lightig CO.,Ltd , https://www.luhaosolar.com